The Growth Agenda

The Growth Agenda

Updated 15 Feb 24 - the UK is now officially in recession

Everyone wants the economy to grow. We want more people employed in well paid jobs in profitable enterprises that in turn deliver the tax revenues we need to fund the welfare state and high-quality public services. We hope this will make our people happier, healthier and more content. We hope that in turn society will become fairer, with more opportunities for all – levelling up as someone once said. And any growth needs to happen whilst committing to Net Zero and proactively decarbonising our economy.

Private enterprise is the principal engine of growth and prosperity for the people of the UK, but business can only succeed within an efficient economic framework provided by Government. A skilled and healthy workforce, efficient transport, coherent and predictable legislation, and easy access to markets are on the Government’s side of the growth equation.

In every part of this the Conservatives have failed in their role. Huge numbers of people have left the UK workforce as they are simply too unwell to work, with nearly 8 million people on the NHS waiting list. Our railways are the most expensive and most unreliable in Europe, our crumbling roads are full, making journeys unpredictable and costly. Our energy supply is fragile and expensive. Brexit has caused higher export and logistic costs with few upsides so far. The Tories took back control but immediately drove us into a wall.

We are in a mess and there is no simple solution. But there are 2 broad missions that we can take on to further the growth agenda: (1) Increase Investment and Productivity; and, (2) Reduce Economic Friction.

Investment and Productivity

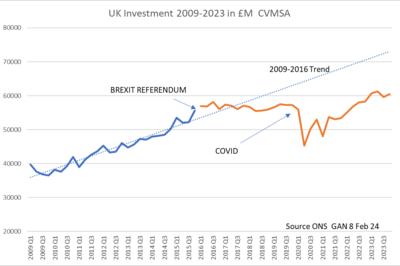

Key to growth (and our overall prosperity) for the country is increased investment to increase efficiency and productivity. The Tories bemoan the UK’s low levels of productivity and seek to blame workers for an inherent laziness and employers for lack of investment appetite. But they have forgotten the maxim that uncertainty stops investment. When a domestic or international business chooses to invest in the UK they are looking for a predictable and stable regulatory environment, access to skilled people, speedy transport and logistics; and easy and consistent access to goods, services and markets. Over the last decade, none of these factors have improved, indeed in some areas they have become notably worse. Consequently, investment into the UK since 2016 has significantly underperformed the upwards trend establlished prior to then.

Regulatory Uncertainty

The Tories have created the perfect environment for supressing investment. Leaving the EU increased regulatory uncertainty and whilst we have a tariff free trade deal, the “non-tariff barriers” add significant cost and delay for exporters. This year sees the first UK checks done on importers, adding similar costs to exporters from the EU into the UK. We have introduced and then dropped the UK CA mark for goods, we were set to drop the thousands of retained EU regulations on a single date (a move even Sunak recognised as catastrophic). Our exporters struggle to keep track of changing EU law as we gradually diverge from the EU’s evolving regulatory framework. The impact on investment from Brexit can be seen below as from the Referendum onwards the UK became a less predictable, stable place to do business.

Confidence

Allied to the regulatory environment is the degree to which we can be trusted. It seems you cannot keep threatening to renege on international agreements and treaties without consequence. When confidence goes – so does investment. In the Sep 22 Truss/Kwarteng mini budget, Truss deliberately sidelined what she referred to as “Treasury orthodoxy” the key institutions – HM Treasury, the OBR and the Bank of England. The markets were spooked. Sterling crashed and the UK instantly became a riskier and more expensive investment. It showed that if the Government breaks with expected standards of scrutiny and evidence-based policy-making, then you (and we) will be quickly found out. There was and is, always a limit on absolute Sovereignty based on the environment in which you seek to exercise it.

Public Sector Investment

When compared internationally UK public investment is low. It has averaged 2.5 per cent of GDP for this century (against 3.7% for our OECD peers) and we can see the impact of this crumbling around us. Public Sector capital investment was much higher at 4.5% of GDP between 1949 and 1978 but this then declined as we privatised much of our public infrastructure services and stopped building houses. But the privatised utilities and transport providers have not stepped up at all, or have invested expensively through debt. Where private monopolies can deliver return to shareholders without significant capital investment there is no incentive to invest. Only regulation can compel investment and if this is weak, we end up with poor and expensive infrastructure. We have the most expensive rail and power in Europe and the most polluted rivers. We need to regulate more effectively, or even consider the previously unthinkable and return some of these failed privatisations to public ownership. Even in the areas that the Government can directly invest, the austerity programme has dampened investment leading to crumbling schools, hospitals, courts, roads, bridges, leisure centres; fewer MRI machines, and insufficient social housing. The Palace of Westminster itself is a leaking, poorly maintained metaphor for itself.

Economic Friction

Our economy has had sand poured into its engine. Nothing is as easy and friction free as it once was. Some if this is due to the poor state of our national infrastructure, but much has come about due to our changed relationship with the EU.

The Remain campaign painted an apocalyptic future outside the EU that was breezily and easily dismissed as “Project Fear”. These overblown predictions of disaster did not come to pass on the day after the Referendum, or on 30 Jan 2020. It has therefore been easy to downplay the impact of leaving the EU as not as bad as Project Fear, and this narrative persists. This Conservative Government, trapped by their own dogma cannot allow introspection and an honest evaluation of what is now worse, and what is now better. In their world, and that of much of the right-wing media, this lack of outright disaster is somehow portrayed as an unalloyed success.

Bureaucracy

Every exporter now has more paperwork to deal with, and whilst many have got good at this, it still slows up exports, adds costs and makes us less competitive. Musicians grapple with carnets and declarations at every border. Shellfish perish waiting for paperwork to clear. More trucks travel empty or sit idling for hours creating tonnes of additional CO2 and pollution. Extra stock and materiel has to be held and housed rather than delivered just in time. Complex rules of origin regulations means that goods imported to the UK, finished and then exported to the EU can attract an export tariff. And all of this will shortly be happening to exporters from the EU to the UK as we belatedly impose our own import checks. These are the Non-Tariff barriers that Johnson explicitly said did not exist within his deal (qv, a lie).

Human Capital

Perhaps the biggest issue caused by the departure from the EU was the sudden impact on labour supply. Until we have invested in the skills we need in the UK we will always need to import skills from abroad. Locked-down-released EU workers went home during the pandemic and were unable to legally return after we had left the EU. Many sectors have subsequently had well publicised shortages. Baristas, chefs, bar staff, lorry drivers, abattoirs workers, seasonal farm workers, social and care staff, nurses; and this is not an exhaustive list. Some estimates suggest that there is a 300,000 EU related labour shortfall. Each of these has resulted in an amendment to the visa scheme as the Government has reactively pulled levers to try to plug the gaps. Simple mutual free movement with the EU has gone, which self-regulated with supply and demand. Where recruiting from further afield, the work migrant is often accompanied by dependants and will be looking at the UK for a longer period. Employers also suffer eye watering Visa and recruitment costs. This is the fundamental difference between mobility of labour, and employment-based immigration. The former is flexible, market driven and short term, the latter is expensive, quota drive, inflexible and long term and has perversely increased net migration.

A Vision for the Future

We need the grown-ups in charge of the UK again. People that understand how business, data and commerce actually works. Honest people with the interests of the people that live here at heart. Not ideologues with a book deal, think tank funding and a Global Britain poster in their playroom. We need to understand that the economy will not grow without investment to drive productivity. We need to understand Sovereignty in the real world and that this will mean pooling this again inside or alongside the EU.

Investment will come once we are again a rational, stable, predictable normal country. It will also come when the infrastructure on which the economy relies improves dramatically which means a step change in Public Sector Investment. Imagine the impact on our cities and if we had cheap fast reliable trains, the reduction in days lost if we could see a doctor or dentist quickly, the impact on education if every child had a laptop and broadband, the benefit and pleasure we would gain from clean rivers and beaches. The busted austerity argument is that we need a good economy before we can have good healthcare, infrastructure and education. The investment argument is that we will never have a good economy until we have good healthcare, infrastructure, education. It is surely time to try the latter.